The Next Wave of Biomanufacturing Innovation

We are at a great inflection point in biomanufacturing: this is an area that First Spark Ventures is very interested in at the intersection of hardware, software, and wetware.

In late February, US intelligence officials revealed that Chinese pharmaceutical giant WuXi AppTec had illicitly transferred American intellectual property to Beijing without proper consent. This revelation ignited concerns about the security of US biotech data and prompted swift responses from lawmakers and industry players alike, resulting in the formation of the Biosecure Act. The act seeks to prevent US companies from engaging with entities deemed “biotechnology companies of concern,” underscoring mounting apprehensions within Congress regarding Chinese access to sensitive US data.

Of course, China’s pivotal role in the global pharmaceutical supply chain adds complexity to this situation: WuXi is to big pharma what Foxconn is to Apple. In anticipation of potential legislative changes, pharmaceutical companies are uniquely strategizing to mitigate risks. AstraZeneca’s decision to develop separate drug supply chains for the US and China markets exemplifies proactive measures to safeguard operations, while Novartis is also weighing changes to its contracting relationships with China before the legislation becomes law. However, such initiatives could inadvertently lead to increased costs and potential quality issues in drug development and distribution: replacing Chinese manufacturing capacity could take upwards of five years and incur substantial pricetags especially for biotech startups, repercussions which would directly contrast the Biden administration’s goal of lowering drug prices. Amid a staggering 20-year high of 323 drug shortages in the US, major modifications in supply chains would only exacerbate existing demand challenges.

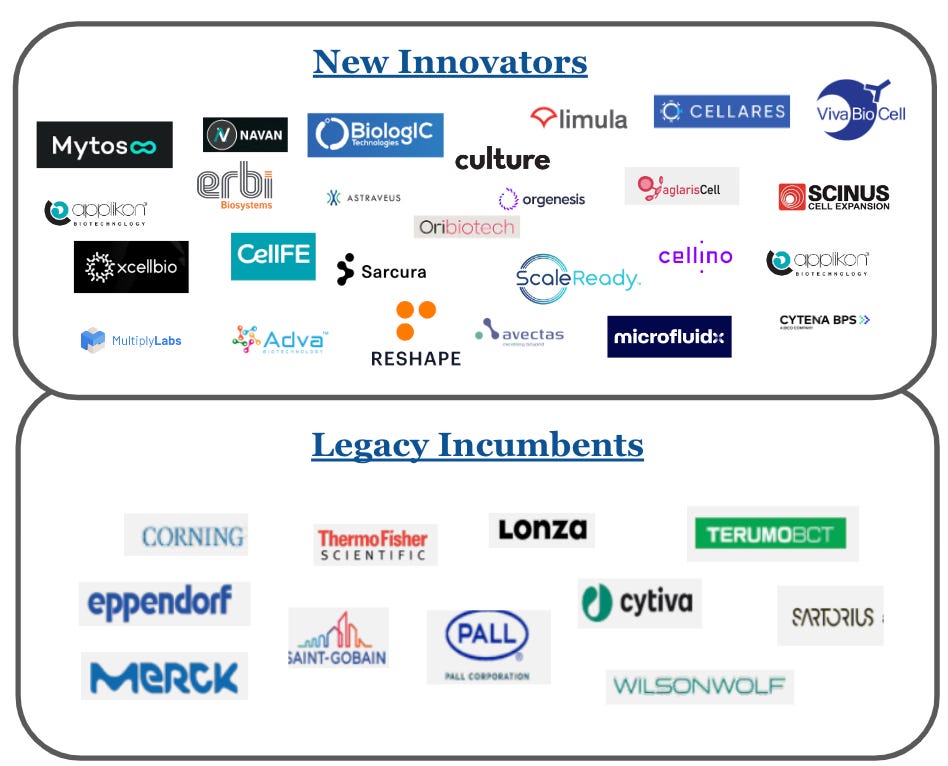

Partnerships and integration of technology from innovative startups could also be an outcome. This year, both Bristol Myers Squibb and Kite announced partnerships with manufacturing startup Cellares to leverage the company’s automated manufacturing platforms and enhance production efficiency. Cellares claims it can reduce manufacturing failure rates, require drastically less labor and shave 50% off of average production costs- this partnership signals that the industry is correcting course with smaller companies. Cellares is joined by many other leaders with different technologies: Ori Biotech, Cellino, ScaleReady, and CellFe amongst many.

As the political nuance in this space continues to develop, it will be crucial to watch for companies creating and disrupting the next-gen manufacturing space with unique differentiated moats. Read below to see our predictions on where there is still white space in broader biologics manufacturing and CG&T manufacturing:

Data and Analytics

The first wave of the data-enabled tool companies in the traditional biologics manufacturing space has already passed, focusing on predictive and prescriptive analytics across large-scale equipment in both clinical and GMP-validated environments.

Aizon, Apprentice, Invert Bio and Ethon AI are just a few examples of companies excelling here with a data-first strategy, while other major names like AWS are also stepping up in partnerships. A predictive data play alone is of fractional utility to large manufacturing teams, as two key pain points still exist:

Key pain point 1: Connectivity between variety of processing instruments for real-time analytics and adjustment in both process development and commercial-grade space

The solution requires a decentralized approach of data amalgamation: one example is Ganymede bio, a company that combines data by connecting every instrument and app like ELNs or LIMS into one FAIR data layer. Ganymede currently targets both mid-size biotechs, and large pharma manufacturing, but the key criteria is that some physical/wet lab process should still be under development.

Key pain point 2: Integration with single use tech and parameters

When I left Genentech manufacturing in 2021, we were just embarking on the journey to build out our large-scale single use facilities, lovingly called our “factories of the future.” In the next ten years, we estimate that all Phase 1/2 production and rare disease commercial production will be done in single use facilities in both mid/large sized biotech and pharma.

Analytics thus must be agile enough to overcome difficulties of scaling new disposable components/ instrumentation and with a variety of different small-batch modalities.

However, software is not the major hurdle here. Having worked these roles, I recognize the cultural shift of teams to accept new ways of working will be the real barrier- how do you upskill technicians who have been excelling in their process-oriented roles for 30+ years to operate a novel data-centric environment?

The bar for capital here is thus extremely high given the uphill slope of integration into well-established teams.

CG&T Manufacturing

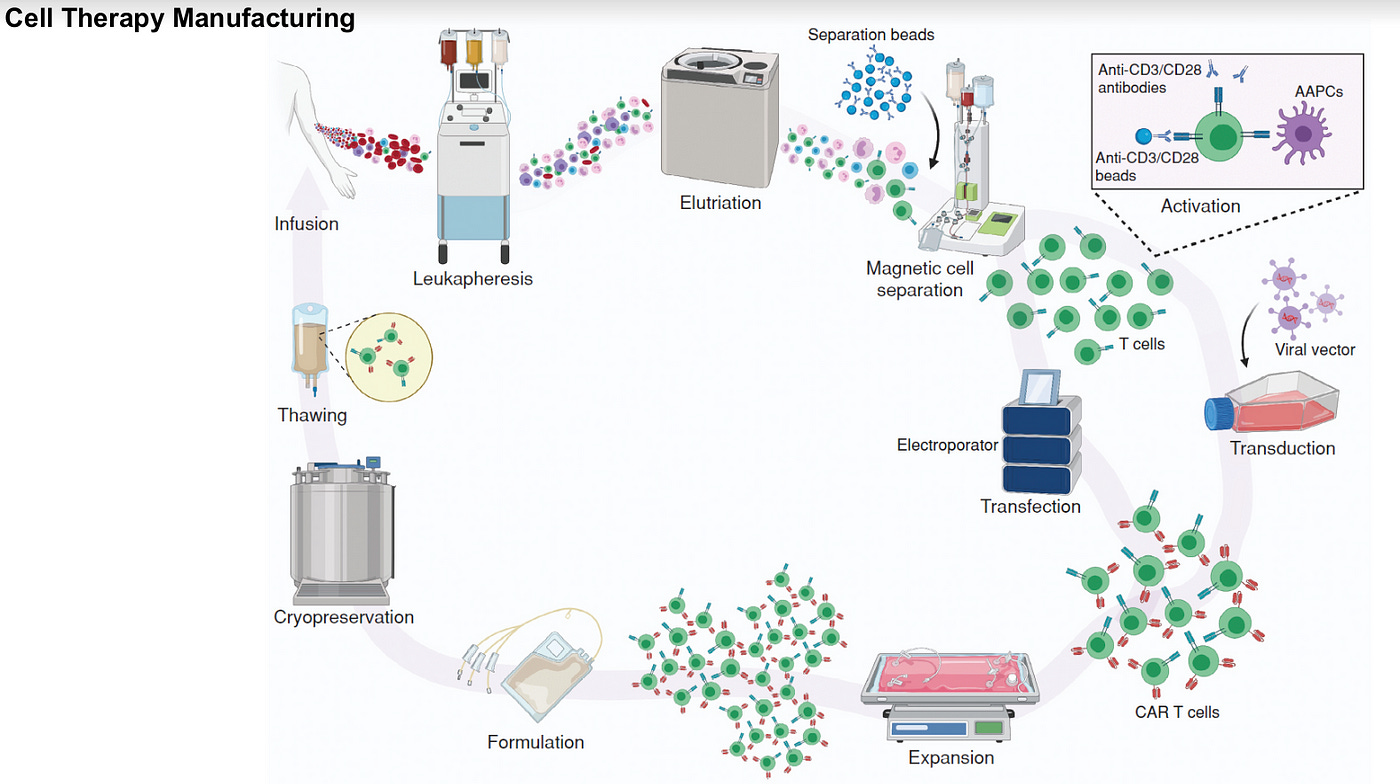

A plethora of companies have popped up over the last few years attempting to expedite and automate some steps within the CG&T manufacturing process. See below for a few of the top players and larger incumbents.

A number of these companies automate or expedite one step of the process, for example cell concentrate and wash. Others have some sort of brute force robotics application as their primary technical moat, in which robotics replicate what a traditional instrument or human would do, and modularize it into a more compact unit that is easily scalable. An added bonus is the real-time digital and predictive analytics most platforms now provide.

However, there have been little improvements in robotic automation- most have already reached the standards that well-scaled incumbents like Ori Biotech, Cellares, and MultiplyLabs have, without much exponential differentiation. In addition, many can only operate in a clinical setting- no company has truly cracked the scale-up from R&D to commercial within one standard module.

Key pain point 3: The robotic automation space is saturated and companies will likely not be able to make impactful advances in this space

We anticipate that the next wave of companies that will innovate on incumbents will combine automated unit operations with miniaturized automated bioprocessing.

One such example is Nutcracker Therapeutics for RNA therapeutics: Nutcracker Therapeutics’ proprietary biochips utilize a fully enclosed microfluidic path that requires minimal hands-on time. Fluids move across multiple chambers to the site of each reaction in a semi-continuous process that enables precise control, reproducibility, and scalability.

What will an ideal future state look like? The ultimate vision would be end-to-end process flow without the need for external manufacturing, either through in vivo CAR-T solutions (see below) or through a “GMP-in-a-box” solution at bedside. We envision a world where the steps from apheresis to infusion can occur at the bedside in as little as one day with advanced processing techniques.

Key pain point 4: Transduction via viral vector is expensive, time-consuming, and is likely the most difficult process in the workflow

Transduction via viral vectors provide pain across the bioprocess chain. A few innovators in stealth are pursuing reagents-based solutions, but we are weary of the extent of impact these will make.

An example is Mirus, recently acquired by Merck, which focuses on the development and marketing of transfection reagents. Their technology includes both proprietary polymer and lipid elements, which, when optimized, enables both high transfection efficiency and low cellular toxicity.

A more robust solution would be a next-gen non-viral delivery system, a space in which there have been at least 100+ early-stage companies creating. The team at Kerna VC have done a great summary here of these solutions and companies, each building upon a weakness of traditional viral delivery systems.

The ideal technology should have high transduction efficacy, low immunogenicity (ideally made of only of genetic construct), great biodistribution and targeted delivery direct-to-cytosol, all while detargeting the liver and keeping manufacturing costs low. Not an easy task here!

Lastly, we see great white space in novel delivery mechanisms that are able to handle a large variety of cargo types, including gene editing nucleases, guides and templates, which can be up to 5kB or more, with ideal delivery to nucleus. Two companies we are closely watching are Nvelop, which recently launched with $100M to tackle delivery in gene editing medicines. The technology behind Nvelop is based on VLPs (virus-like particles) and the company is backed by the likes of Atlas, GV, 5AM, ARCH and F-Prime.

Aera’s approach is also unique. They use a protein nanoparticle (PNP) delivery platform that can self-assemble to form capsid-like structures and that can package and transfer nucleic acid cargo. The team’s technology also includes a proprietary therapeutic enzyme platform based on the discovery of novel, compact, and programmable gene editing enzymes.

We are at a great inflection point in manufacturing with the breakneck speed that automation and biology are traversing. Alongside the large impact from macro political changes, white space emerges that is ripe for innovation at the intersection of hardware, software, and wetware.