A Commercially-Driven Best-in-Class Therapeutic

What unique differentiators will the next wave of pharma blockbusters need to have?

Keytruda vs Opdivo as the winning PD-L1 agonist in solid tumor. Mounjaro vs Wegovy as the winning GLP-1 for weight loss. Ocrevus vs Kesimpta as the winning aCD20 in MS. It’s a battle as old as time: as big pharma’s pipelines begin to look increasingly similar across large-scale indications and modalities, products must be truly best-in-class as opposed to first-in-class: oftentimes there is less major differentiation across efficacy and safety. Visionaries highlight a new recipe to beat order-of-entry benchmarks without simply relying on clinical gains; perhaps through other differentiating dimensions such as route of administration, dosage frequency, and expanding into sub-indications. Products chasing these unique formats are often underestimated by analysts with order-of-entry expectations, but lead to high returns on market given their direct-to-patient benefits.

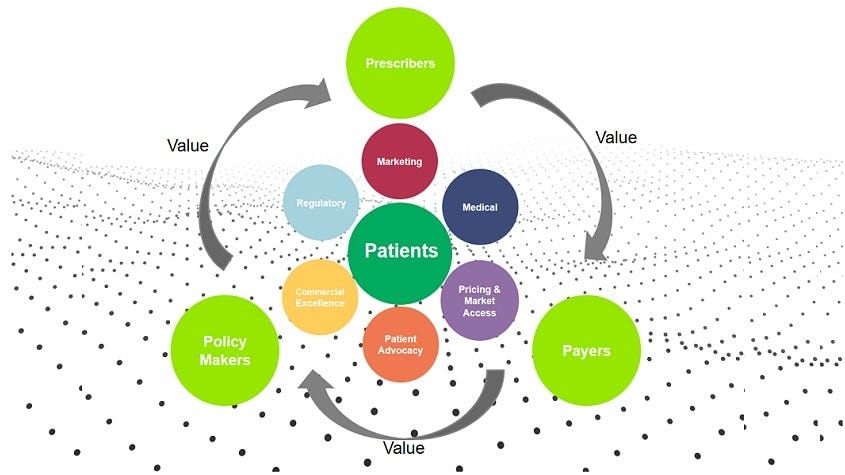

Another opportunity is through a robust yet unique commercial strategy. In my previous piece, I highlighted my excitement for AI-led innovation focusing on the commercialization of drug products, through product-led scale as opposed to clinical. Surfacing a few additional areas that interest me:

Prognosis Tools and Companion Digital Therapeutics in Neuroscience

We’re all scared of addressing the elephant(s) in the room surrounding digital treatments. Akili and Pear Therapeutics were both examples of two of the major pioneers of the digital therapeutics space, the latter of which crashed and burned only a few years after IPO. The obvious difficulty Pear faced is the current reimbursement framework of this class of products: it is hard to characterize the value of digital treatments as they may not be considered a core therapeutic add-on. However, contrary to popular sentiment, in recent months there are a few macro-environmental changes that leave me bullish on searching for continued innovation here.

Clarity on Function and Reimbursement Pathways

In Sept 2023, the FDA drafted guidance highlighting a path for digital drugs to combine with new or existing drug treatments, PDURS. These products must be supported by one or more adequate trials and enhance medical treatment paradigms, functioning independently or in conjunction with other therapies. The draft guidance helps elucidate the role of these technologies for pharma companies, opening the door to conversations on widespread usage of products.

More recently, last month, Medicare proposed creating payment codes for some digital mental health treatments, which would allow doctors to bill for using them as part of a patient’s care (!!). The proposal, included in Medicare’s 2025 physician fee schedule draft rule, isn’t a silver bullet, but is movement in the right direction, and probably signals more to come with other indications.

General Research and Indication Advances

There has been more movement in neuro space in the last decade than we have seen since the birth of biotech, producing large-scale real world data for digital solutions. With oncology and autoimmune indications likely falling out of favor in the next 10 years due to expiring patents, policy, and payor pressure, indications like Alzheimers, Parkinson’s, ALS, Depression, Schizophrenia and more have had therapeutic successes in Kinsula, Leqembi, KarXT, Qalsody, and other assets. This is matched by a a voracious M&A appetite from big pharma in this space. Two of my favorite early-stage research advancements:

Brain imaging combined with machine learning can reveal subtypes of depression and anxiety, according to a new study led by researchers at Stanford Medicine. The study, published June 17 in the journal Nature Medicine, sorts depression into six biological subtypes, or “biotypes,” and identifies treatments that are more likely or less likely to work for three of these subtypes.

Researchers at the University of Cambridge have developed an artificially-intelligent tool capable of predicting in four cases out of five whether people with early signs of dementia will remain stable or develop Alzheimer’s disease. This new approach could reduce the need for invasive and costly diagnostic/ prognostic tests while improving treatment outcomes early when interventions such as lifestyle changes or new medicines may have a chance to work best.

What would a successful company need to have? A DTX company will entice a therapeutic product’s commercial traction when paired and formulated correctly:

A clear indication strategy: A general neuro approach across 5+ indications does not make sense, the technology must be more specific (<3 indications ideally with similar prognosis pathways)

Indications selected must have therapeutics on the market or in late-stage trials to pair with.

Team must have some superior data moat in the indications they are working in: use of public data sets will not suffice- usually working with a top-tier academic institution with some unique research insight as per the above will already give a leg-up.

Open infrastructure for generalist HCPs

An ideal approach is applicable in a PCP’s/generalist neurologists office and does not require specialized technology or input from a neuro-specialist .

Reimbursement/ pharma

As noted, this is always the main issue. Hence, why it is encouraged to have pharma partnerships and conversations VERY early on to work with them on reimbursement considerations.

A solely health system approach will not work in this climate, and neither will a solely diagnostic/clinical focused approach

From a pharma product development teams’ perspective, the regulatory hurdles of filing in combination are hard- it's also extremely difficult to convince a Ph2/Ph3 team to take on another risk during development especially if the additional clinical benefits are not crystal clear. Lastly, funding for additional components beyond the therapeutic itself is next-to-impossible in this climate: nobody has gotten a drug-digital combo through the FDA yet, examples are always after approval.

Bottom line: it would be smart to focus on an approach for pharma commercial teams to get excited about the product (also these teams are where the $$ is), either through an adherence or medication titration play, more on a prognosis front as main utility to set a competitive edge against other major playors. An example I worked on was Floodlight, a digital product used to enhance and track a patient’s MS treatment alongside Genentech’s Ocrevus.

Tools to accelerate commercialization

I previously alluded to immense white space in tools for pharma commercial teams. A double click on some recent updates and white spaces:

Pricing and access

Recent movement with major bodies like Pharmacy Benefit Managers (PBMs) in the last few months could allow for white space in access and pricing management.

A PBM is a third-party administrator of prescription drug programs (covering over 266 million Americans), operating inside of integrated healthcare systems (e.g. Kaiser), as part of retail pharmacies (e.g., CVS Pharmacy), or as part of insurance companies (e.g., UnitedHealth Group). The six largest PBMs control almost 95% of the prescriptions filed in the US, allowing them to influence which drugs are available and at what price ranges.

The FTC recently produced a scathing report on “how [these] prescription drug middleman profit at the expense of patients by inflating drug costs and squeezing pharmacies". Chief executives from the three largest PBMs recently attended congressional hearings, which will continue to play out in the next few months- depending on these outcomes, PBM reconstruction could lead to an open area to play in pricing and access.

I also see value-based initiatives (where reimbursement and payment is based on effectiveness/outcomes of treatment) being especially pertinent and top-of-mind with CMS’ new sickle cell pilot (see my previous thoughts here)

In a well-functioning healthcare system, effective drugs should be accessible and affordable. The US does not mandate pricing based on Health Technology Assessments (HTA’s, ex: ICER) the way other governments do. Most of these bodies focus on payer perspective at the moment, and either do not include other benefits and costs to society or take a narrow societal perspective.

Ideally, a metric defining therapeutic interventional quality, often observed as Quality Adjusted Life Year (QALY), should be assessed using disease severity, product lifecycle dynamics, and broader impacts beyond the patient. Both pharma and insurers need technology to appropriate re-evaluate QALY (or another patient-focused metric) and create robust contracting agreements.

Too many companies in the pricing space focus on health system angle of this problem, while there is room for traction in a pharma or insurer-centric approach here (and more $$ to spend): a winning company will create a full suite of tools addressing patient-focused pricing, contracting, and rebates.

Sales and marketing:

There are many digital companies innovating here. Real scaling challenges are going to be cultural within veteran sales teams, which is a harder battle to win: the team must also have deep (very deep) roots within pharma commercial to gain true traction.

Ideal innovation links across multiple pain points:

Customer multichannel digital engagement, genAI for marketing material, and AI-based recommendations per customer - With the rise of consumer digital marketing boldly pursued by other industries, pharma needs to be rapid in changing their sales approach to entice a new wave of millennial doctors now at the helm of prescribing decisions. Commercial teams are now switching to a world that will eventually boil down to an n=1 framework for customer marketing, personalizing content and claims for each individual doctor’s beliefs.

Forecasting predictive analytics- According to an analysis in Nature Reviews Drug Discovery, the majority of pharma forecasts for drug products are off by more than 40%. This is important, because most companies use these forecasts to make investment decisions from a large commercial balance sheet. Superior AI-based forecasting technology is needed to decrease the margin error down significantly and properly adjudicate spend.

Cloud services- Veeva and Salesforce, which dominated the Cloud/CRM pharma market, have now split, losing control over a once-saturated landscape. This leaves some market share to integrate new players into the pharma cloud ecosystem if they have something innovative to add to the table. (However, this begs the question of whether a life science-focused cloud service is even necessary if a Snowflake etc. could eat up this market with a dedicated team)

Real world data- Put simply, the rise of precision medicine and the above-mentioned need for hyper personalization lead us to a world in which the structuring and analysis RWD is essential. There are still painpoints:

Large-scale clinical, labs, claims data do not always show you full patient picture due to lack of ability to link various datafeeds (and combine with consumer data) – especially in rare disease. In additional, complex treatments require multiple nuanced steps in the patient journey, which data often doesn’t capture.

Potential solutions: federated learning play across amalgamation of datasets, synthetic data generation for training models

Example: Record linkage is a critical aspect of Datavant’s technology. Using tokenization, Datavant can link records pertaining to the same individual across different data sets without revealing their identity, including EHRs and clinical trial records.

Firewalls between internal teams are very strong (medical, commercial, development, etc.) and HIPAA constraints patient-level customization

Potential solutions: Data encryption/privacy plays, data tokenization

Example: Tokenization also involves hashing and encrypting PII, transforming it into a token that cannot be reverse-engineered to reveal the original data. For example, a name like "John Smith" is always converted into the same unique token. Since different data sets may capture various PII elements, Datavant creates multiple tokens for a single piece of PII, ensuring comprehensive protection across diverse data environments. Advanced algorithms enable these tokens to be matched across different records without exposing the underlying PII, allowing for the secure linkage of patient records from disparate sources.

Reliance on historical data does not always show full story due to capture rates- commercial team cannot uncover new HCPs and patients to target.

Potential solutions: AI-based prescriber mapping and alerts to identify uncovered patients and community providers

Example: Veeva’s tools identify addressable patients along with key prescribing indicators, which are then aggregated at the HCP level to quantify new, untapped potential.

Ultimately, patients will benefit if they can get personalized treatment faster and more efficiently delivered to them. I am a firm believer the next best-in-class drug blockbusters will use AI and digital to accelerate an unprecedented commercial strategy. If you are building or investing in these spaces, I would love to hear from you.