2025 TechBio Predictions

Top six areas I believe will hit traction in techbio beyond discovery and design this year, from data to product commercialization

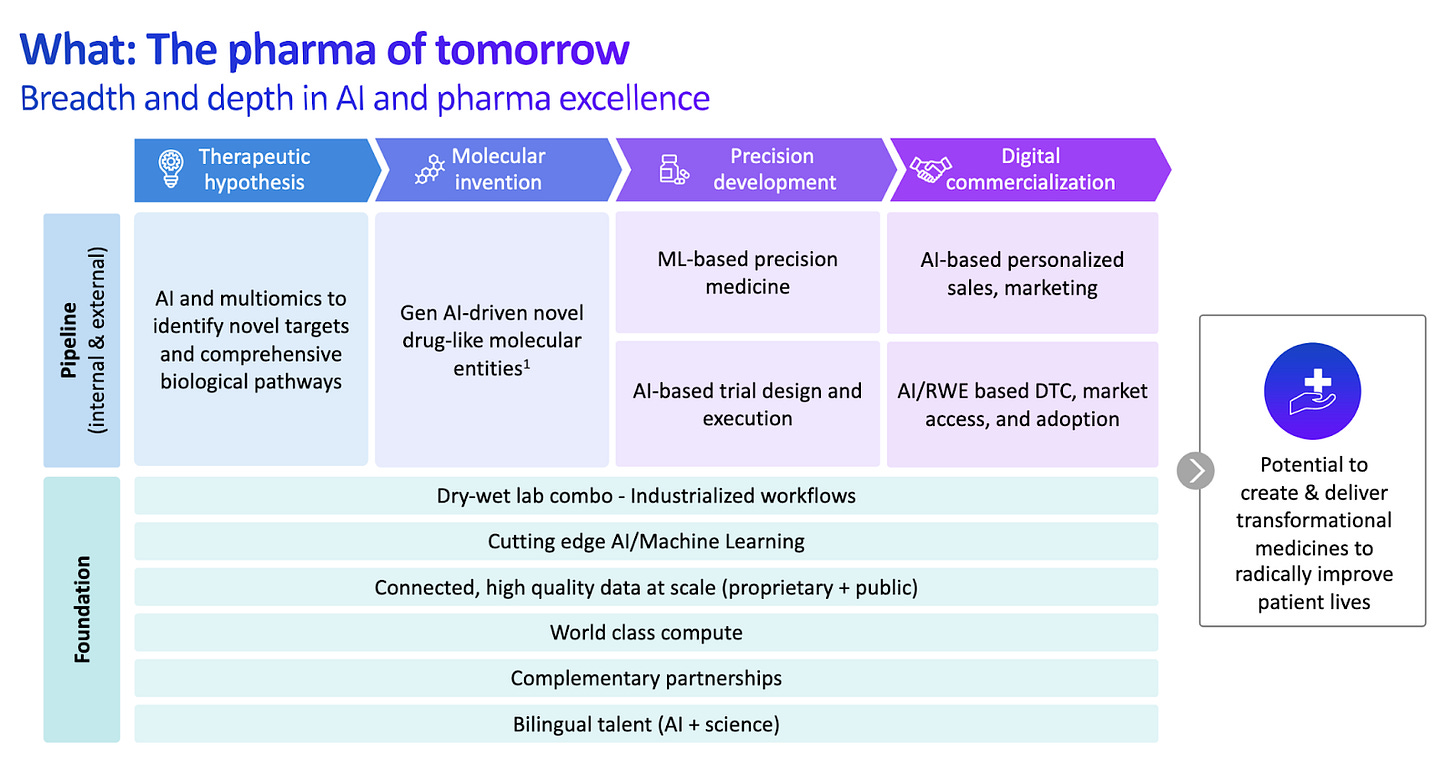

2025 is off to the races! J.P. Morgan was of course the highlight of January, connecting with likeminded investors and founders across the techbio spectrum. It’s clear we are squarely in a wave of companies built fundamentally on technology to create first and best-in-class drug products. While there have been a slew of companies integrating computation in the research and discovery phase of the biotech value chain, far and few in between integrate AI fully across the value chain, throughout development, manufacturing, and commercialization. Recursion has a bold commitment to the below, showing what a company of the future could look like. Recently funded companies like Formation Bio and Manas AI also follow in the footsteps of the AI-centric biotech beast, proudly claiming to optimize and automate end-to-end pharmaceutical drug formation.

With this stage set, see the top six areas I believe will hit traction in techbio beyond discovery and design this year, from data to product commercialization.

The federation of RWE and epigenetic data will lead to the rise of next-gen health datasets.

Fully realizing the potential of precision medicine requires a comprehensive, multi-dimensional understanding of the patient’s response to therapy. New multi-modal datasets will combine real-world evidence from de-identified medical records with genomic profiling, enabling deeper insights into biology and perfecting treatment paradigms.

Two recent examples of this work: Truveta recently raised $320M for the Truveta Genome Project to sequence up to 10M exomes, integrating genetic data with medical records in partnership with Regeneron, Illumina, and 17 U.S. health systems. Guardant Health and ConcertAI also announced a strategic collaboration to combine comprehensive patient EMR data and epigenomic tumor profiling. With these types of combinatory innovations, we’ll see health data startups reconfigure their business models to become full-scale partners for pharma companies instead of one-off service providers, generating recurring revenue.

There is still low-hanging fruit in trial operations that, once infused with automation, can get a company to the commercialization finish line (sometimes even without the most alluring asset)

Recursion predicts 65-70% of their resources are spent in clinical development: logistics including protocol-development, regulatory filing, and site selection. We will continue to see a large crop of companies this year using AI and LLMs to automate documentation processes and streamline workflows in clinical trials. Lindus Health, Collate, and Faro Health are a few amongst many innovators partnering with pharma directly.

My long-term prediction? There are too few examples of successful enduring service product companies: I’m bullish on an incoming slew of Formation Bio-esque companies: asset-driven companies developing a first-in-class product from unique logistics automation insights: efficiently completing state-of-the-art trials <8 years. Companies will likely start by repurposing known modalities and targets for new indications as they validate their platform.

Companies creating digital twins and virtual cells will continue to make large headway this year: we’ll see new business models and new indications explored.

2024 was the year of the development digital twin: the use of RWD and causal AI to simulate clinical trials before their initiation to help adjust patient inclusion and exclusion criteria, stratify more suitable patient populations, and estimate the likelihood of operational success ahead of study launch.

While we will eagerly watch the success of the first wave of these companies, my prediction is that more will emerge but with different paradigms or business solutions: most of the first cohort (a la Unlearn, QuantHealth) have yet to crack a commercial model that fully locks in high revenue. We’ll also see technological innovation crop up from academia: Charlotte Bunne’s group at EPFL, for example, is one of many that focuses on AI-powered virtual cells.

Trump’s new policies will leave white space for American innovation in AI and automation for commercial biomanufacturing: pharma and academics alike are taking notice.

The Trump administration has made it clear through impending tariffs in its first few weeks that the sustainability and resiliency of the biomanufacturing supply chain and production in the US is a national security priority. In the midst of companies making strategic moves to reduce risks through nearshore or onshore manufacturing, there is room for new innovators to gain market share with new computational or automation moats.

New methodologies will likely emerge from academic settings (see: Purdue University, in collaboration with Eli Lilly and Merck & Co. has announced the launch of the Young Institute to develop disruptive innovative technologies) or from talented dropouts from existing data or hardware-led biomanufacturing incumbents, like Bioraptor or Multiply Labs. These innovators will likely be lapped up by larger US-based CDMOs, or directly by pharma at early stages.

Alternatively, another business model will emerge with “mini CDMOs,” focused in optimal design and construct of various genetic components. Terrain Biosciences recently launched and provides biotech startups with high-quality RNA through rapid, scalable manufacturing.

The upstream market capture of radioisotope manufacturers will continue in greater heat this year.

Radiopharma drugs continue to remain a hot area of interest, with 38 companies and 45 clinical stage programs developing top quality assets. Isotope supply is crucial for large-scale development, made clear as Eli Lilly made a small bet into entering upstream into the business of nuclear isotope production investing $10mn through a convertible loan into isotope supplier Ionetix last year.

This year, exits and market consolidation have grown tremendously to capture precious cargo. Lantheus Holdings spent $250 million upfront to buy radiopharma CDMO and diagnostics company Evergreen Theragnostics, while BWX Technologies said it will buy isotope supplier Kinectrics for $525 million. Market capture of isotopes will likely continue well into the next few years of development and will be a space to track.

2025 will be filled with the continued rise of consumer-focused biomarker innovation.

If you’re anything like me, you hopped on the Oura ring bandwagon and are (somewhat?) continually thrilled by the data at your fingertips. We’ll see more this year of consumer companies generating large-scale datasets to better understand biomarkers and physiology.

Two eminent examples: Apple recently announced an ambitious research initiative that will analyze data from a multitude Apple devices to better characterize human health, while Tempus launched olivia, an AI-enabled personal health concierge to empower individuals to holistically organize, manage, and proactively take control of their own health data. Unclear whether the intermingling of consumer and biotech focus is one that excites or scares me…

From precision medicine to trial operations, digital twins, biomanufacturing, radiopharmaceuticals, and consumer biometrics, 2025 is shaping up to be a transformative year for techbio. Any other spaces you would add?